Combining a broad operative experience and deal flow knowhow of Barcelona and Madrid, the team of professionals from BMB Investment launch a REIT in the market that they know best, the Spanish real estate market.

The REIT will invest and optimize leased residential properties in the two top cities of Spain.

BMB Investment specializes in Private Equity value creation projects. It was founded in 2006 with the mission to provide tailor-made investment opportunities to qualified investors. BMB focuses on niche markets with substantial return potential and controlled risk, but where larger institutional investors chose not to invest due to the lack of scale/volume available.

Each Partner brings in an average of 20 years of relevant experience.

Today, BMB with offices in Berlin and Barcelona is positioned as an international renown firm with a positive tracking record since inception and key partners in different countries.

BMB Team expertise:

- Deal origination

- Portfolio Management

- Financing

- Property Optimization

- Property Management

- Network de agentes

AUM by BMB Investment:

- EU 250 M

- 90 buildings in Europe

- 200.000 m² rental space

- 2.500 units

- EU 17 M yearly rent income

THE SOCIMI (Spanish REIT)

Taking advantage of the SOCIMI tax regime, we designed a REIT that offers risk-controlled returns. These are derived from the rent income and the market upside generated from the selective acquisition of the properties and through active management.

The strategy is to invest in buildings in Barcelona and Madrid with the following characteristics:

- “Cherry picking” off market properties

- Selection of unique opportunities

- Mainly residential rented buildings

- Controlled risk: low Capex, no development

- Purchase prices near construction costs

- Purchase prices about 50% below peaks

Fact Sheet:

| – Purchase price: | @ € 1,900 m² |

| – Value per property: | @ € 2-10 M |

| – Exit price: | @ € 3,650 m² |

| – Targeted REIT size: | €50-100 Million |

| – Optimization: | From day one |

| – Duration: | Max. 7 years |

| – Targeted IRR: | +15% per year |

INVESTMENT POTENTIAL

Allocating assets to residential properties, that are well managed and well rented, is traditionally a quality safeguard investment, because these investments generate returns in all market conditions given the solid underlying and the income from small, but very sustainable, tenants.

BARCELONA & MADRID FIGURES

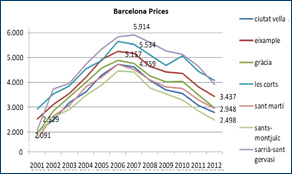

Prices:

- @ € 3,250 m² (50% below peaks)

- Short term stagnation of prices

- Mid term upside potential

- Rent yields stabilizing

- Mid term potential for rent increase

Macro-economic data:

- Low growth

- Expensive cost of financing

- High unemployment

- GDP growth expected in 2-3 yeas

Today, we find that in Barcelona and Madrid, two world known cities, prices are near historic minimums and close to construction costs, values that shall act as a safety net.

By its euro denomination the fund implies an investment in a solid currency in a very consolidated market within the main business areas in Europe.

The possibility to own, rented and well managed, real estate assets in Barcelona is an unprecedented opportunity.

The expected IRR of +15% can be topped up if financing is eventually used, thus accelerating equity return to investors and increasing rates of return.